SIP in Mutual Fund: Best dates to do mutual fund SIPs

Every day we get numerous queries of multiple natures pertaining to mutual funds in Advisorkhoj.com. Queries range from questions regarding mutual fund schemes, asset allocation, lump sum or Systematic Investment Plan, lump sum or Systematic Transfer Plan, so on so forth.

A few weeks back, I got a query from a friend, which we had never got before. This friend, a mutual fund investor for many years, was starting a few SIPs in mutual fund. He called me and said that he had selected the funds for the SIP, but he wanted my advice on SIP dates. I told him to choose any date because it did not matter. According to the Random Walk Hypothesis of Stock Prices, stock prices move at random in the short term and therefore cannot be predicted. In any case, through monthly SIPs in Mutual Funds, investors average out cost of purchase over a long investment horizon.

A few days later, I met this friend in a Navratri function and he brought up the topic of Mutual Fund SIP dates again. He understood the Random Walk Hypothesis, but he told me that, he had heard from someone that, SIP in Mutual Fund with auto debit dates at the end of the month give higher returns in the long term than SIP in Mutual Fund with auto debit dates at the beginning of the month. I was not convinced with this hypothesis because stock prices can rise or fall in any month, but my friend was not ready to let go of the theory. He wondered if there is an advantage of investing near the expiry of the Futures and Options series of the month, because stock prices are usually volatile during F&O expiry. I was still not convinced, but I promised to my friend that I will do a historical data analysis to see if this “SIP date advantage” holds water.

Having completed this analysis, I will share with our readers (including my friend), if there is any advantage in selecting SIP auto debit dates to get higher returns. Before I share the results of my analysis, let me reiterate that there is no theoretical basis of advantage of any particular SIP date or dates because of two reasons that I discussed earlier. Just to recap, Random Walk Hypothesis states that stock prices do not follow any trend in the short term and therefore, there is no systemic advantage in selecting one particular investment date (or dates) versus another in SIP in Mutual Fund. Secondly, even if we assume that, stock prices in certain dates in a month are more volatile than other dates due to some monthly events (e.g. expiry), the volatility (upside or downside) is random and therefore, rupee cost averaging in SIPs in Mutual Fund will ensure that the effects of volatility are averaged out.

Statistics is a funny subject. I once read in a financial blog published in the US, that S&P 500 (the most popular stock market index in the US and perhaps the world) has a good correlation with butter production in Bangladesh. This correlation seems to suggest that, instead of doing complicated equity research, if an investor had good knowledge of butter production in Bangladesh, he or she could have got superior returns in the US stock market. This is an example of a spurious correlation. The relationship between SIP dates and returns is not as bizarre as that between S&P 500 and butter production in Bangladesh. The point I am trying to make is that, statistical results are what they are; for the purpose of investments, we should try to find some logical basis in statistical results, before we believe and act on them.

Let us now discuss the results of the analysis of Mutual Fund SIP dates and investments results. For doing the results, I chose Nifty and not any mutual fund scheme. If I chose a scheme, then there would be the question, why this scheme and not another one. Nifty and Sensex are the two most important benchmark for Indian stock market. I did not choose the Sensex because it comprises of only 30 stocks; Nifty with 50 stocks is more representative of a mutual fund scheme, in terms of number of stocks in the portfolio.

I looked at SIP returns for Rs 10,000 monthly SIP over the last 10 years for different SIP date scenarios (please note that, I wrote SIP date scenarios instead of particular SIP dates, because if the market is closed on the SIP date mentioned in your SIP auto-debit or ECS form, units will be allotted to you based on the NAVs of the next business day). The four date scenarios are:-

- SIP date at the beginning of the month – the 1st of the month or the next business day (if the 1st is a holiday)

- SIP date at the end of the month – the last business day of the month

- SIP date around F&O expiry – the F&O expiry for a particular series takes place on the last Thursday of any month. The date of F&O expiry will change from month to month, but in your SIP auto-debit (ECS) form, you have to select a particular date. For the purpose of this analysis, we have assumed the F&O expiry takes place around 25th of every month (or the next business day, if 25th is a holiday)

- Two SIP dates every month – the SIP will be done in two instalments (Rs 5,000 each) every month. One at the beginning of the month and another around 15th (or the next business day, if 15th is a holiday).

Let us now share the SIP results for these four scenarios.

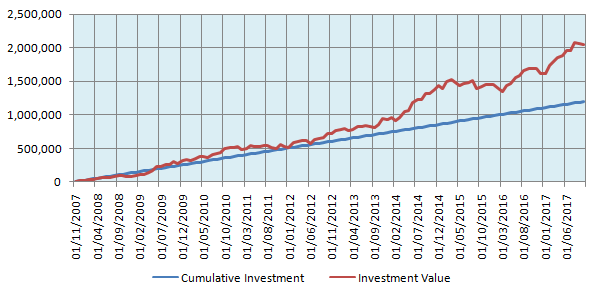

SIP at the beginning of the month

The chart below shows the returns of Rs 10,000 monthly SIP in the Nifty with instalments at the beginning of every month, over the last 10 years.

Source: Nifty data from NSE website

The cumulative investment is Rs 12 lakhs over the last 10 years. The investment value as on October 6th 2017 was Rs 20.69 lakhs.

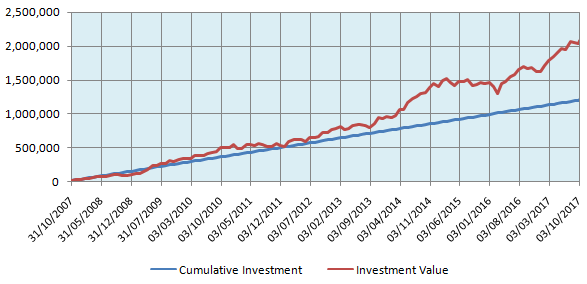

SIP at the end of the end of the month

The chart below shows the returns of Rs 10,000 monthly SIP in the Nifty with instalments at the end of every month, over the last 10 years.

Source: Nifty data from NSE website

The cumulative investment, like in the previous scenario, is Rs 12 lakhs over the last 10 years. The investment value as on October 6th 2017 was Rs 20.83 lakhs. The returns were higher by about Rs 15,000 compared to the previous scenario. On a cumulative investment of Rs 12 lakhs, Rs 15000 additional profits represent a very slight (almost insignificant, in my opinion) advantage. Therefore, in my view there is no significant advantage of investing at the end of the month, instead of beginning of the month.

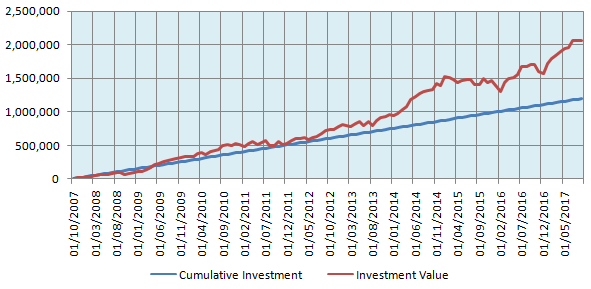

SIP around the time of F&O expiry

The chart below shows the returns of Rs 10,000 monthly SIP in the Nifty with instalments around the 25th of every month, over the last 10 years.

Source: Nifty data from NSE website

The cumulative investment, like in the previous two scenarios, is Rs 12 lakhs over the last 10 years. The investment value as on October 6th 2017 was Rs 20.89 lakhs. The returns were slightly higher by about Rs 9,000 compared to the previous scenario (end of month SIP) and by around Rs 24,000 compared to beginning of month. On a cumulative investment of Rs 12 lakhs, Rs 15000 or Rs 24,000 additional profits represents almost insignificant advantage. Therefore, in my view there is no significant advantage of investing around the F&O expiry dates, instead of beginning of the month or end of month.

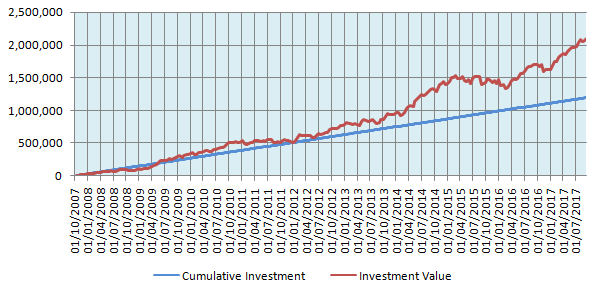

Two SIP dates – Beginning of month and mid of month

The chart below shows the 10 year returns of two Rs 5,000 SIP instalments every month, one at the beginning of the month and one in the middle of the month.

Source: Nifty data from NSE website

When I was analyzing this scenario, I thought that, this might be the best scenario because this two SIP dates can probably take better advantage of volatility through rupee cost averaging. However, once I saw the results, my belief in the Random Walk Hypothesis and Rupee Cost Averaging was re-affirmed. The cumulative investment in this scenario, like in the previous three scenarios, is Rs 12 lakhs over the last 10 years. The investment value as on October 6th 2017 was Rs 20.75 lakhs. The returns were slightly higher compared to beginning of month SIP but slightly lower than end of month SIP or SIP around F&O expiry.

My take on Mutual Fund SIP dates

There is no significant systemic advantage to be gained, by selecting any particular SIP date for your SIP in Mutual Fund, as per the results of our analysis. Still if you are interested in gaining even the slightest of advantages, it seems, on the basis of this analysis that, you are slightly better off, investing towards the end of the month or near the F&O expiry (the F&O expiry takes place near the end of the month).

However, my take on dates of SIPs in Mutual Fund SIP is that, you should choose a SIP date, as per your personal situation and convenience. The most important consideration in choosing anMutual Fund SIP is ensuring sufficient funds in your bank account for the SIP transaction to go through. If the SIP transactions do not get executed for three consecutive months due to insufficient funds, then your SIP might get cancelled. The risk of having insufficient funds in your bank account is much lower at the beginning of the month than towards the end for salaried people.

The slight advantage of choosing Mutual Fund SIP auto-debit date at the end of the month notwithstanding, you should consider your monthly expense pattern to see, if you have the risk of having insufficient funds in your bank account towards the end of the month. If you feel confident that, you will always have sufficient balance in your bank account, you can choose end of month (or near expiry) SIP auto-debit dates for your SIPs in Mutual Fund; else, keep it simple and choose the SIP date at the beginning of every month and stay invested with your Mutual Fund Systematic Investments Plan (SIP).

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.