Which mutual funds is best to invest in lieu of Fixed Deposits

In Advisorkhoj queries we often get questions like, “which mutual funds to invest in lieu of Fixed Deposits” from multiple investors. A related question that we also often get is that, “my FD is maturing. I will not like to renew because of lower interest rates. What are some good alternative options?” Interest rates have come down by around 200 basis points in the last 2 years or so. It is understandable that investors are worried about lower income and want to explore alternative options. However, when comparing two different investment types investors should clearly understand the difference between the two and then decide which product is more suited for their needs.

At the very outset, we want investors to understand the most important difference between fixed deposits and mutual funds. The interest rate of a fixed deposit is fixed for the term of the deposit. The interest rate of the fixed deposit will not change during the term of the deposit irrespective of what happens to interest rates in the economy. Mutual funds on other hand invest in market securities and therefore subject to market risks; price of a security in the market (equity, debt or money market) can change on a daily basis, depending on a variety of factors which will discuss later.

The nature of risk varies from fund to fund, but the underlying point is that mutual funds are not risk free and they do not give assured returns. This is the fundamental difference between fixed deposits and mutual funds. The relationship between risk and return is the most fundamental in finance. You can get higher returns only if you take more risks. Therefore, it is very important to investors to understand how much risk they can take and base their investment decision on their risk capacity.

Different types of risk

Let us now analyze different types of risk in fixed income investments. There are 3 types of risk –

- Interest Rate Risk – Interest rate risk is the sensitivity of the price of a fixed income security to changes in interest rates.

- Credit Risk – Credit risk is the risk of default (non payment of interest and / or principal) by the borrower. Please note that in fixed income, the investor is the lender and the counter party (bank, bond issuer, Government etc) is the borrower.

- Reinvestment Risk – Reinvestment risk is the risk of the maturity proceeds of an investment being reinvested at a lower rate of return (interest rate) than the original investment.

We will discuss how these risk types affect different investment products. Let us start with fixed deposit.

Fixed Deposits

Fixed deposits have no interest rate risk because fixed deposit is a fixed maturity investment. As discussed earlier, the interest paid by a FD is fixed for the term of the FD. Let us now discuss credit risk. Bank FDs have no credit risk; in other words, you will get the interest and your principal back on maturity of the FD. Reserve Bank of India regulations ensures that banks have sufficient capital at any point of time to meet its obligation to all the depositors. Government Small Savings Schemes also have no credit risk because Government schemes have sovereign guarantee.

However, fixed deposit schemes issued by companies can be subject to credit risk. Readers who follow business news regularly will know that, there are multiple cases (which are currently sub judice) where the fixed deposit issuer has defaulted on interest and / or principal payments. You should invest only in fixed deposit schemes which have been approved by the RBI. Credit rating agencies like CRISIL assign ratings to company fixed deposits. You should avoid investing in company fixed deposits which have lower credit ratings.

Let us now discuss re-investment risks. Once your FD matures, you will be able to renew it at existing interest rates; if interest rates at the time of maturity are lower than your old FD rates, then you will get lower returns in the future.

Mutual Funds

Different mutual funds have different risk categories. Securities and Exchange Board of India (SEBI) has labelling system (Risk-o-Meter) for grading risk of different mutual fund products. You can find the risk grade (and corresponding Risk-O-Meter) of different mutual funds schemes on the Asset Management Companies website. The different risk grades are:-

- Low Risk: These are mutual fund schemes with lowest risk. They are good investment options for investors looking for income and low risk of capital loss. Different categories of debt mutual funds are in this risk grade

- Medium Risk: These are mutual fund schemes with moderate risk. These funds are more volatile and the risk of capital loss in the short term is higher than low risk funds. However, these funds can give better returns in the medium to long term than the low risk funds and are suitable for investors who are looking for income and also capital appreciation. Different types of hybrid (both equity and debt) mutual funds, like monthly income plans, equity savings funds etc, are in this risk grade

- High Risk: These are funds at high risk. The risk of capital loss in the short term is highest in these funds, but these funds can give the highest returns in the long term to investors looking for capital appreciation over a long investment horizon. Equity funds are in this risk grade.

Since fixed deposits are low risk investments, the appropriate mutual funds for the sake of comparison should be low risk mutual funds, e.g. debt funds.

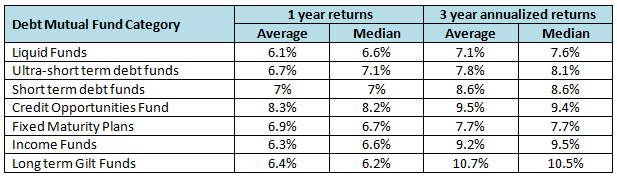

What are debt funds? Debt funds are mutual fund schemes which invest in money market or debt market securities. Money market securities include commercial papers, certificates of deposits, treasury bills etc. Debt market securities include Government bonds and non-convertible debentures (corporate bonds). Even though most debt funds are low risk mutual funds, you should remember that they are not risk free. But these funds can give superior returns than Fixed Deposits over various investment tenures. There are different categories of debt funds with different risk return profiles. The table below shows average, median and maximum returns of different debt fund categories over the last one year and three years respectively.

Conclusion

You can see that, most debt mutual fund categories were able to beat last 3 year FD returns over a similar period. Even in the last one year, fund categories like short term debt funds, credit opportunities funds and FMPs were able to outperform FDs. At the same time you can see that, fund categories which underperformed in the last one year, were able to outperform over the last 3 years. Earlier in the post, we had discussed that mutual funds are subject to different risks and that, risk and return are correlated. It is therefore very important to match investments with your specific requirements, so that you can take the optimal level of risk to get the optimal return. In the next part of our post, we will discuss, the characteristics of different types of debt funds and how you can select funds based your specific requirements. Please stay tuned......

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.